Cruising Into Success: Opening the Possible of Offshore Trust Services for International Riches Conservation

The Benefits of Offshore Trust Services for Riches Preservation

You'll be surprised at the advantages of overseas depend on solutions for wide range conservation. Offshore depend on solutions use a variety of benefits that can aid you guard your properties and guarantee their lasting development. Among the key benefits is the capacity to safeguard your riches from prospective financial institutions and lawful insurance claims. By placing your assets in an overseas trust fund, you develop a legal barrier that makes it challenging for others to access your wealth. If you live in a nation with an unstable political or financial climate., this is specifically beneficial.

An additional advantage of overseas count on solutions is the possibility for tax optimization. Several offshore jurisdictions supply positive tax obligation legislations and motivations that can help you lessen your tax obligation liability. By using these services, you can lawfully reduce your tax burden and optimize your wealth buildup.

In addition, offshore trust fund solutions give a higher level of personal privacy and discretion. Unlike in onshore jurisdictions, where monetary details might be easily obtainable, offshore depends on offer a higher level of anonymity. This can be especially appealing if you value your personal privacy and intend to keep your monetary events very discreet.

In addition, overseas trust fund solutions provide flexibility and control over your possessions. You can select the terms and conditions of the trust, specify how it must be handled, and also establish when and just how your recipients can access the funds. This degree of control permits you to customize the trust fund to your individual needs and goals.

Understanding the Legal Structure of Offshore Trusts

Understanding the legal framework of offshore depends on can be intricate, but it's essential for individuals seeking to protect their wealth - offshore trustee. When it concerns offshore counts on, it is necessary to recognize that they are controlled by details regulations and laws, which differ from jurisdiction to jurisdiction. These legal structures establish just how the depends on are developed, handled, and tired

One trick facet to take into consideration is the selection of the jurisdiction for your overseas depend on. Each jurisdiction has its very own collection of regulations and policies, and some might provide extra desirable problems for riches preservation. You'll require to take a look at factors such as the security of the legal system, the level of confidentiality given, and the tax implications prior to making a decision.

When you've picked a jurisdiction, it's essential to recognize the legal needs for establishing up and maintaining an overseas trust. This consists of abiding by reporting commitments, making certain proper paperwork, and adhering to any limitations or constraints imposed by the territory. Failure to satisfy these demands can lead to economic and legal repercussions.

Trick Factors To Consider for Selecting an Offshore Count On Jurisdiction

When determining on an offshore count on jurisdiction, it's important to thoroughly think about aspects such as the territory's lawful security, level of privacy, and tax ramifications. Choosing for a territory with desirable tax regulations can aid maximize the benefits of your overseas trust fund. By very carefully thinking about these elements, you can pick an offshore depend on territory that suits your needs and gives the required level of protection for your wide range.

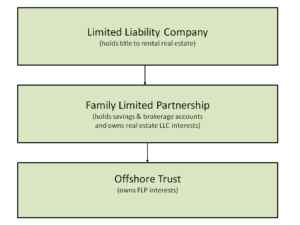

Taking Full Advantage Of Asset Protection Via Offshore Trust Fund Frameworks

Taking full advantage of asset protection can be achieved via offshore trust structures that offer a protected and confidential setting for protecting your wealth. By making use of offshore trust funds, you can protect your properties against potential lawful claims and guarantee their long-term conservation.

Offshore depend on frameworks use a range of advantages that can help shield your assets. One vital benefit is the capacity to establish count on jurisdictions with solid legal structures and robust property security regulations. These territories are frequently popular for their commitment to confidentiality, making it difficult for litigants or creditors to accessibility information regarding your trust or its properties.

Furthermore, offshore depends on provide a layer of anonymity. By placing your assets in a depend on, you can maintain a certain level of personal privacy, shielding them from undesirable focus or analysis. This can be particularly helpful for high-net-worth people or those in sensitive professions.

In addition to property defense, offshore count on frameworks use tax obligation advantages. Some territories enforce little to no tax on revenue created within the count on, allowing your wide range to expand and intensify gradually. This can lead to significant tax obligation cost savings and increased wide range conservation.

Overall, overseas count on frameworks offer a private and safe and secure atmosphere for preserving your riches. By taking full advantage of asset security through these structures, you can ensure the long-lasting preservation and my website growth of your assets, while taking pleasure in the advantages of personal privacy and tax obligation advantages.

Discovering Tax Benefits and Conformity Requirements of Offshore Trusts

Checking out the Homepage tax benefits and conformity needs of offshore counts on can offer important understandings right into the lawful obligations and economic benefits connected with these frameworks. Offshore counts on are often situated in territories that offer positive tax obligation programs, such as low or absolutely no taxes on count on earnings and resources gains. By positioning your assets in an offshore depend on, you can legitimately minimize your tax obligation and optimize your wide range conservation.

Conclusion

So there you have it - the capacity of overseas trust services for international riches conservation is tremendous. By recognizing the benefits, legal structure, and vital considerations, you can make educated choices to take full advantage of property defense. Additionally, checking out the tax benefits and conformity demands of overseas trusts can further improve your riches preservation methods. Do not lose out on the possibilities that offshore trust services can use - cruise right into prosperity today!

When deciding on an overseas trust jurisdiction, it's vital to carefully take into consideration variables such as the jurisdiction's legal security, level of privacy, and tax obligation ramifications. By carefully taking into consideration these aspects, you can select an overseas depend on jurisdiction that matches your requirements and provides the essential level of protection for your riches.

Offshore counts on are often situated in territories that provide desirable tax regimes, such as reduced or zero taxes on count on revenue and resources gains - offshore trustee. By YOURURL.com putting your properties in an offshore count on, you can legally lessen your tax obligation and maximize your wide range preservation. Furthermore, discovering the tax benefits and conformity requirements of overseas trust funds can even more boost your wealth preservation approaches